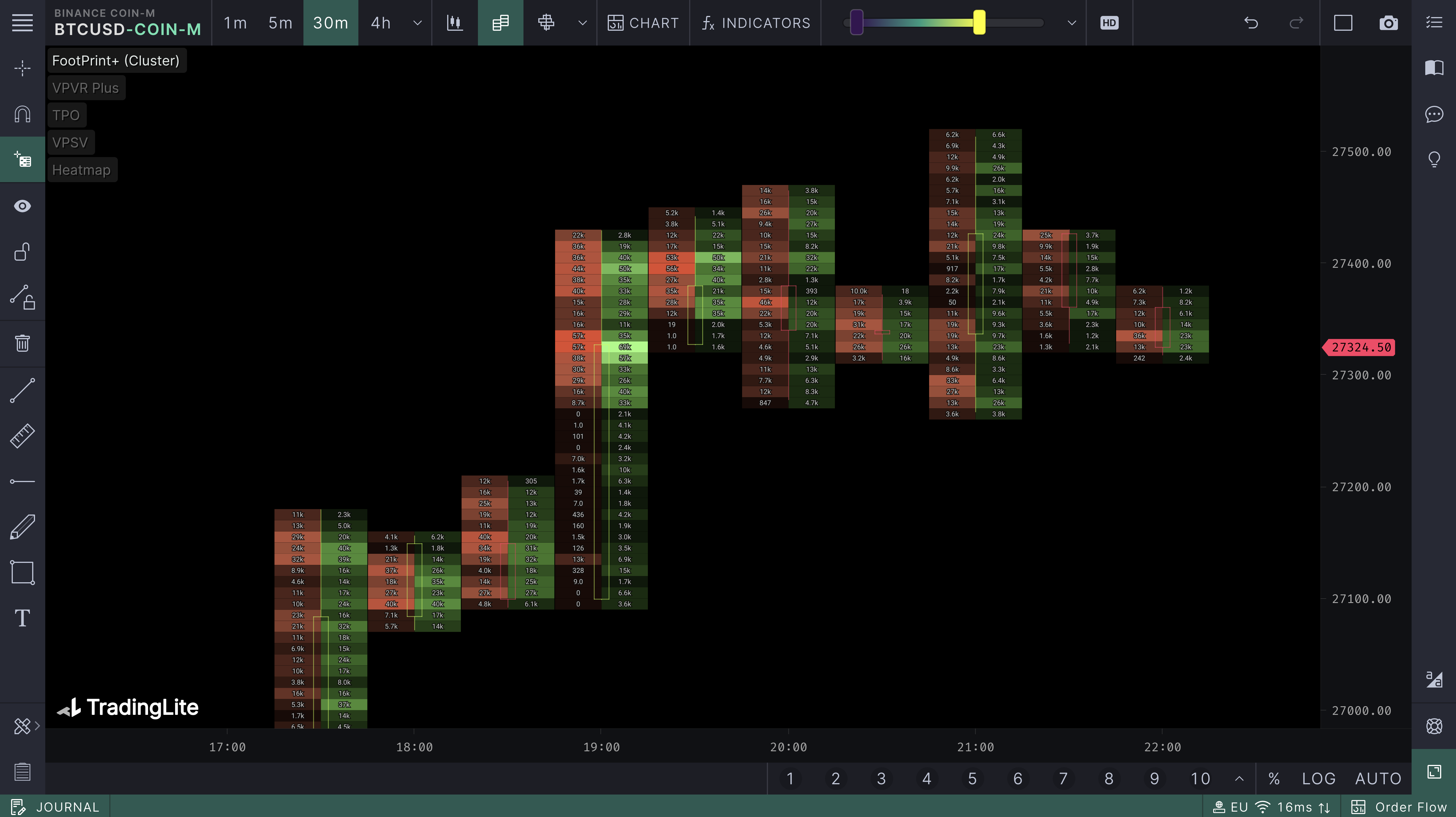

Liquidity & Order Flow technical analysis platform

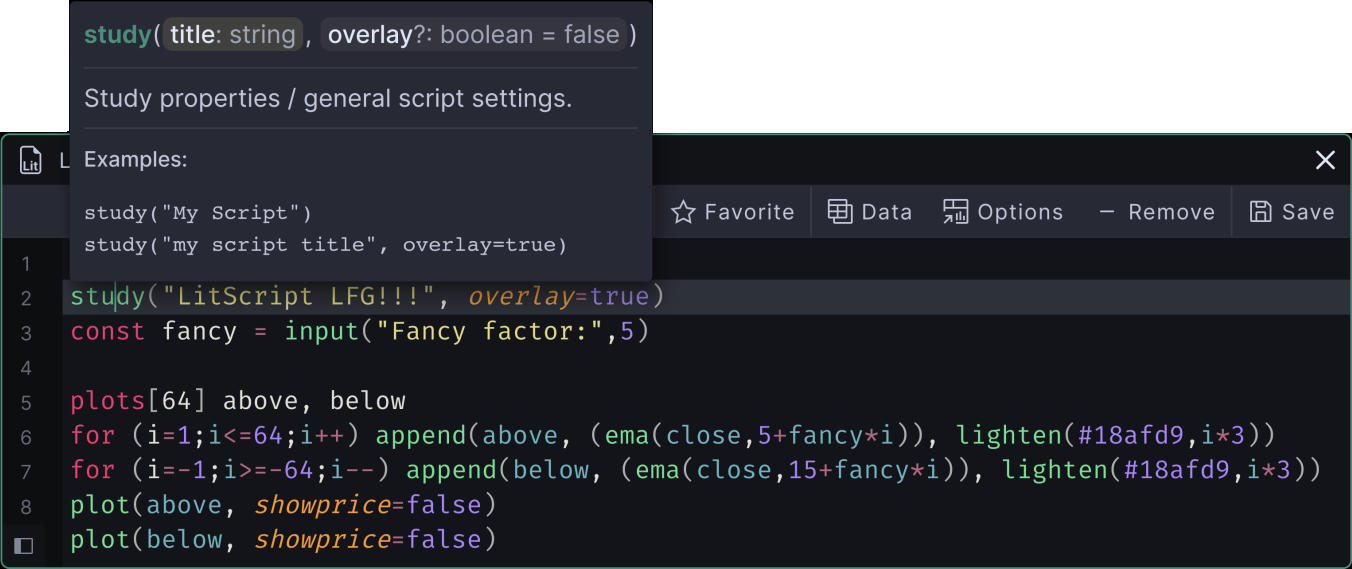

Define your edge in crypto via our real-time liquidity heatmaps, order flow suite & over 500 community created tools.

Try now - for free!

Define your edge in crypto via our real-time liquidity heatmaps, order flow suite & over 500 community created tools.